Admin > Fees

Pracsoft supports standard fee columns (Medicare Benefits Schedule, Medicare Rebate) and up to 14 user-defined fee columns providing enough flexibility to cater for fees on a per-practitioner and per-institution basis.

Pracsoft provides you with a Standard Fee list of over 100 commonly-used items. The Standard Fee list can include item numbers that use alpha characters (e.g. Hep B) for use with items that are not in the Medicare Benefits Schedule.

Fee can be added, edited, updated, deleted and reactivated. If you have created a fee formula for a customised fee, or the standard fee columns have changed because of an update, you will need to recalculate each customised fee column.

To Manage Fees

From

the Waiting

Room, select Admin

> Fees. The Fee

Listing window appears.

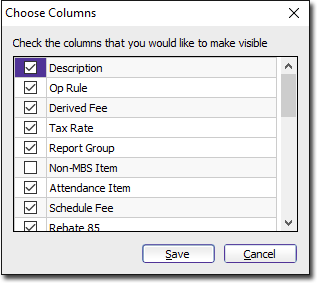

By

selecting the Choose

Columns option (available via the View menu on the Fee

Listing window), you can modify the layout of the window, hide

columns and rearrange the order in which the columns are shown.

Click

the  ,

,

and

Print buttons

to manage fee listings.

and

Print buttons

to manage fee listings.

To

find a specific item number, click  The Find

Item No window appears.

The Find

Item No window appears.

Enter

the item number and click

Item No |

Displays the fees item number. |

Description |

Displays the fees description. |

Op Rule |

Allows you to select this item as an operation rule. Pracsoft will calculate the highest fee for the 100% rebate, the second highest for the 50% rebate and the third highest for the 25% rebate when a fee is selected as an op rule. If selected, the 'operation rule' fee scaling will apply to the selected item. |

Derived Fee |

Derived fee items are entered as item numbers followed by a forward slash (/) and the number of patients attended (for example 35/4 represents item number 35 with 4 patients attended). |

Tax Rate |

Allows you to set a tax rate for specific service items.

Previously this field was used to set the GST rate (10%). However, as from Pracsoft 3.14, GST is calculated automatically. As such, this field can be used to set other tax rates (such as those for overseas patients, for example).

If a practitioner has chosen to set their own GST rates for service items (as configured via the Practitioner Details window), any rates recorded here in the Tax Rate column will override the practitioner's rates. |

GST Not Applicable |

Exempt a fee from GST by ticking this check box. |

Report Group |

Allows you to enter the report group. |

Non-MBS Item |

Indicates whether the fee is a non-MBS item. This field is hidden by default. |

Attendance Item |

Allows you to identify the item as being an attendance item and therefore the rules of 100% Medicare Rebate applies. For example, if a Practitioner is who is not a specialist performs an attendance item service, the rebate will be 100% of the Scheduled Fee. All other services will attract the 85% rebate or, if performed in hospital, 75% of the Schedule Fee. |

Fee

Columns |

Displays individual details of the fee columns. |

|

Allows you to search for specific item numbers. |

|

Allows you to create a fully-customised service item. |

|

Displays the Fee columns and allows the fee names and recalculation parameters to be changed. |

|

See Importing/Updating MBS Fees for detailed information. |